Contact Us

Committed to Helping Our Clients Succeed

Read our Latest Blog Posts

Will Writing, Lasting Power of Attorney, Probate & Estate Planning

Why Lasting Power of Attorney Matters: Safeguarding Your Future Decisions

The thought of losing control over your life decisions can be a daunting one. Life is unpredictable, and in certain circumstances, we may find ourselves unable to make crucial decisions about our health, welfare, finances, or property. This is where the concept of Lasting Power of Attorney (LPA) comes into play.

An LPA is a legal document that allows you to appoint one or more people to make decisions on your behalf should you lose the capacity to do so yourself. It's a safety net, ensuring your voice is still heard even when circumstances prevent you from speaking. In this blog post, we will delve into the importance of an LPA, helping you understand why it is a critical tool in safeguarding your future decisions. We'll shed light on what an LPA is, why you need one, and how to go about setting one up. Let's embark on this journey of securing your future and protecting your autonomy.

Understanding Lasting Power of Attorney

A Lasting Power of Attorney (LPA) is a legal document that gives another individual or individuals—the 'attorneys'—the authority to make decisions on your behalf if you're unable to do so yourself. This can be due to various reasons, such as mental or physical incapacity.

There are two types of LPA: Health and Welfare, and Property and Financial Affairs.

A Health and Welfare LPA covers decisions about your daily routine (like eating and dressing), medical care, moving into a care home, and life-sustaining treatment. It can only be used when you're unable to make your own decisions.

On the other hand, a Property and Financial Affairs LPA lets your attorney manage your finances and property while you still have mental capacity, or if you lose it. This could include paying bills, collecting benefits, selling your home, etc.

It's important to note that an LPA is different from a General Power of Attorney because it remains valid even if you lose mental capacity. A General Power of Attorney becomes invalid in this case. An LPA is also different from a Living Will or an Advance Decision, which only includes instructions about your future treatment if you can't communicate them, but doesn't appoint someone to make these decisions on your behalf.

Setting up an LPA ensures that your affairs will be handled according to your wishes, providing you with peace of mind about the future. The appointed attorney(s) should be trustworthy individuals who understand your values and wishes, and who will act in your best interest at all times.

The Need for a Lasting Power of Attorney

The future is unpredictable, and while we hope to maintain our independence and decision-making abilities for as long as possible, life can throw unexpected curveballs. Illnesses like dementia, stroke, or accidents can occur suddenly, leaving you incapable of making your own decisions. In these scenarios, having a Lasting Power of Attorney (LPA) can be invaluable.

Without an LPA, your loved ones might have to apply to the court to gain the legal authority to handle your affairs, a process that can be time-consuming, stressful, and expensive. However, with an LPA in place, the person or people you trust will have the legal power to make decisions on your behalf.

An LPA isn't just for those who are older or in poor health. Even young people can benefit from having an LPA if they become incapacitated due to an accident or sudden illness. It serves as a form of insurance, providing reassurance that your interests will be protected and your wishes respected, no matter what happens.

Moreover, an LPA allows you to decide in advance the decisions you want to be made on your behalf if you lose capacity to make them yourself. It also allows you to choose who will make these decisions. This level of control and foresight can be comforting, ensuring that even in the worst scenarios, your voice is still heard.

Process of Setting up a Lasting Power of Attorney

Establishing a Lasting Power of Attorney (LPA) might seem like a daunting task, but with the right guidance and support, it can be straightforward. Here's a step-by-step process to help you understand what's involved:

1. Choose your attorney(s): The first step is to decide who you trust to make decisions on your behalf. This could be a spouse, family member, close friend, or professional adviser. You can appoint more than one person if you wish.

2. Decide on the type of LPA: As mentioned earlier, there are two types of LPAs – Health and Welfare, and Property and Financial Affairs. You can choose to set up one or both, depending on your needs.

3. Complete the LPA form: The LPA form can be downloaded from the relevant government website or obtained from a legal adviser. The form needs to be filled out with details about you, your chosen attorney(s), the type of LPA, and how you want the attorney(s) to act.

4. Sign the LPA: Once the form is completed, it needs to be signed by you, your attorney(s), and a certificate provider. A certificate provider is a person who confirms that you understand the LPA and haven't been pressured into signing it.

5. Register the LPA: The final step is to register the LPA with the relevant government office. There is usually a fee for this, and the process can take up to 10 weeks.

While it's possible to set up an LPA on your own, it's often beneficial to seek professional advice. This ensures the LPA is set up correctly and meets all your specific needs. At RedLake, we're here to guide you through each step, ensuring you understand the process and providing expert advice tailored to your unique situation.

Choosing Your Attorney

Selecting the right attorney(s) for your Lasting Power of Attorney (LPA) is an essential step. This is the person or people who will be making important decisions on your behalf, so it's crucial they are individuals you trust implicitly.

Here are some factors to consider when choosing your attorney:

1. Trust and Understanding: Your attorney should be someone you trust to make decisions in your best interest. They should have a good understanding of your wishes, values, and preferences.

2. Willingness and Ability: Ensure the person you choose is willing and able to take on the responsibility. Acting as an attorney can be time-consuming and sometimes challenging, so it's important they're prepared for the task.

3. Location: It might be practical to choose an attorney who lives close to you. This can make it easier for them to manage tasks such as paying bills or dealing with property matters.

4. Co-operation: If you're appointing more than one attorney, consider how well they'll work together. Will they be able to cooperate and make joint decisions?

5. Financial Acumen: If you're setting up a Property and Financial Affairs LPA, it can be helpful if your attorney has some financial knowledge or experience.

By carefully considering these factors, you can ensure that you select the right attorney(s) to act on your behalf. Remember, this is a significant decision, so take your time to think it through. At RedLake, we're here to provide guidance and support throughout this process, helping you make the best choices for your unique situation.

Common Misconceptions about Lasting Power of Attorney

Even though a Lasting Power of Attorney (LPA) is a crucial tool for safeguarding your future decisions, there are some common misconceptions about it. Let's debunk some of these myths:

1. "LPAs are only for the elderly." While it's true that LPAs are often associated with old age and dementia, they're not exclusively for the elderly. Anyone can become incapacitated at any time due to accidents or illness. Therefore, it's prudent for adults of all ages to consider setting up an LPA.

2. "My spouse or close family can automatically make decisions for me." This is not true. Unless you have an LPA in place, your loved ones do not automatically have the legal right to make decisions on your behalf, even if they are your spouse or close family member.

3. "Setting up an LPA means I lose control." On the contrary, setting up an LPA allows you to maintain control by choosing who you want to make decisions for you and how you want them made. The LPA can only be used when you're unable to make decisions yourself.

4. "I don't need an LPA, I have a Will." A Will and an LPA serve different purposes. A Will outlines what should happen to your assets after your death, while an LPA covers decisions made on your behalf while you're still alive but unable to make them yourself.

Understanding these misconceptions can help you make informed decisions about setting up an LPA. Remember, an LPA isn't a loss of control, but a way to ensure your wishes are adhered to when you can't express them yourself.

Conclusion

A Lasting Power of Attorney (LPA) is a powerful tool that ensures your voice is heard, even when circumstances prevent you from making decisions yourself. By appointing trusted individuals to act on your behalf, you can have peace of mind knowing your wishes will be respected and your affairs handled as you would want them to be.

An LPA isn't a sign of losing control, but a proactive measure to secure your future. To navigate this process smoothly, professional advice can be invaluable. Remember, setting up an LPA is not just planning for the worst, it's empowering yourself for all future possibilities.

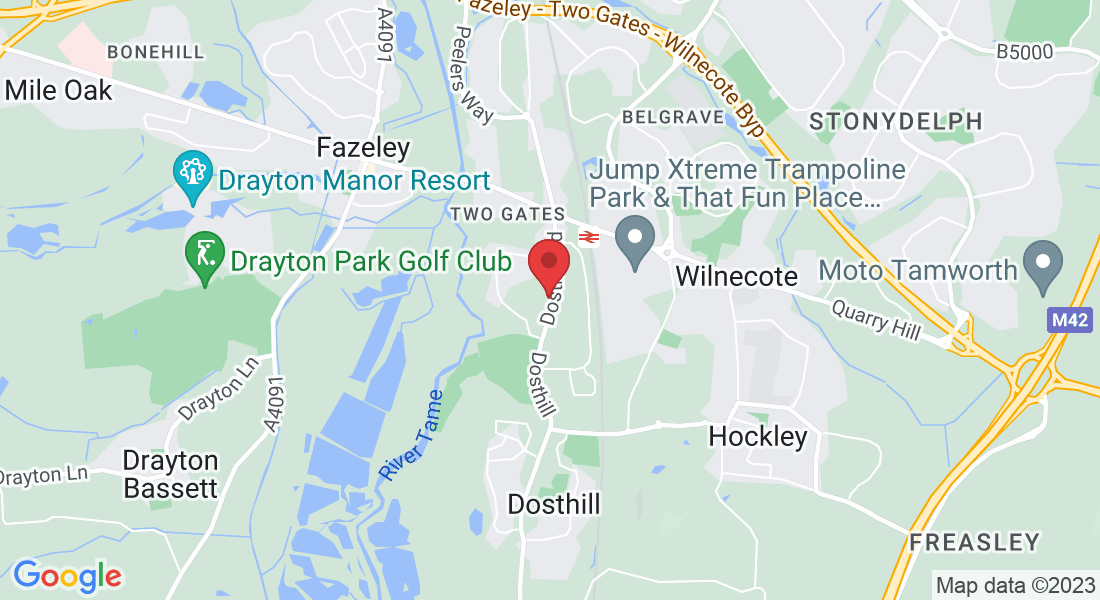

To get started and set up your LPA, give us a call on 01827 287287 or CLICK HERE to get in touch.